by R SIVANITHY (30 Nov)

SINGAPORE - Once the month-end window-dressing of the major indices seen last week is over with (probably early this week), it's very likely that Wall Street and markets in this part of the world will revert back to reacting to the dismal economic and earnings news that's being issued, news that's not expected to be good.

On Monday for example, the US market will have to ponder the release of the November Institute of Supply Management (ISM) manufacturing report. Independent research firm Ideaglobal over the weekend had this to say about the report: 'We expect the headline measure will continue pushing lower in Nov to 38, declining from 38.9 seen in Oct.'

'The manufacturing sector has seen consistently weak results thus far in 2008...thus far in Oct, the headline measures for both New York and Philadelphia painted a very grim picture for manufacturing in the coming months...overall, the lack of new domestic business activity will continue to overshadow declining external demand for US goods and services throughout the remainder of 2008 and into 2009.'

It also added that the US Treasury bond market has fully priced in a deep contraction in Q4 GDP and a very weak start to 2009.

Investors should not forget the not-insignificant problems faced by the US auto industry and the very real likelihood of Detroit, like Iceland a couple of months ago, going bankrupt.

In addition, the US housing market shows no signs of recovery and could in fact be worsening.

Alan Abelson of US newspaper Barron's reports in the Nov 24 issue that the latest victim is commercial real estate.

'The cost of buying protection against default of commercial-mortgage-backed securities has shot up in a notable hurry. The index that tracks such things has more than doubled since (Treasury) Secretary Paulson changed gears on the use of TARP (the US$700b Toxic Assets Rescue Plan that was scrapped recently)', wrote Mr Abelson.

'The yield on such paper with the highest credit rating is now a startling 12 percentage points above the yield on Treasury securities of comparable maturity.'

Our guess is that the Wall Street's bounce last week, supposedly in response to news that the Federal Reserve is to provide an US$800b lifeline for consumer debt was most probably mainly short-covering-induced, aided by a desperate attempt to window-dress the performance of a dismal month and/or year so far.

This process has been also assisted by 'buy' calls from some quarters on the basis that 'markets are oversold' (which in itself is no reason to buy when you really think about it if there are no earnings to speak of) and that all-time laughable classic, 'Asia is decoupled from the US and Europe's problems', which is a hackneyed soundbite trotted out every few years by a financial community that got it spectacularly wrong in 2008 and which can easily be consigned to the scrapheap by pointing out that throughout 2008, Asia has performed much worse than the US or Europe.

Looking further ahead into 2009 though, and you'd have to admit that with the Fed about to run its printing presses at full tilt, the sheer weight of US dollars being printed and thrown at the problem must sooner or later reflate the economy.

As an interesting side issue, it's worth noting that if the Fed were a commercial lender, it would be bankrupt by now. Elsewhere in Barron's Nov 24 issue it is reported that the Fed's capital adequacy ratio is now under 2 per cent, the threshold considered dangerously low.

As former president of the Cleveland Fed Lee Hoskins is quoted saying 'The Fed has violated two principal tenets of central banking - don't lend to insolvent institutions and don't lend on anything but the most pristine collateral'.

Our guess is that any recovery though, if it occurs, will only appear in late 2009 at the earliest. Until then, there will be the odd bear rally to provide some solace for battered bulls, bear rallies like the one seen last week. Investors should tread carefully or risk being caught in yet another bear trap.

-Research Report by R SIVANITHY (30 Nov)

Sunday, November 30, 2008

Noble Group 281108

Noble Group has been on the rise since hitting a low of 0.660 on 20 nov. It has also broken the long term downtrend resistance (low red) today, testing the 1.01 resistance (blue --) too.

Has Noble Group formed a double bottom? By the looks of things at them moment, I'd be tempted to say yes. But knowing the erratic and often unpredictable trading patters of Noble Group, we would have to at least wait until Noble Group breaks the 1.10 neckline (red --) before we can safely say it has formed a double bottom.

We could see some profit taking (not forgetting it has been on the rise for the last 6 days), with Noble Group trading between the 1.01 resistance (blue --) and 0.900 support (red ...).

For monday :

Support @ 0.965 (mid blue, green --), 0.915 (low red), 0.900 (low pink, red ...), 0.855 (blue ...), 0.795 (pink --), 0.740 (low blue, pink ...)

Resistance @ 0.995 (upp pink), 1.01 (blue --), 1.05 (green ...), 1.065 (upp blue), 1.10 (red --), 1.115 (mid red)

Has Noble Group formed a double bottom? By the looks of things at them moment, I'd be tempted to say yes. But knowing the erratic and often unpredictable trading patters of Noble Group, we would have to at least wait until Noble Group breaks the 1.10 neckline (red --) before we can safely say it has formed a double bottom.

We could see some profit taking (not forgetting it has been on the rise for the last 6 days), with Noble Group trading between the 1.01 resistance (blue --) and 0.900 support (red ...).

For monday :

Support @ 0.965 (mid blue, green --), 0.915 (low red), 0.900 (low pink, red ...), 0.855 (blue ...), 0.795 (pink --), 0.740 (low blue, pink ...)

Resistance @ 0.995 (upp pink), 1.01 (blue --), 1.05 (green ...), 1.065 (upp blue), 1.10 (red --), 1.115 (mid red)

Indofood Agri 281108

Is Indofood Agri trying to form a triple bottom? (1st bottom was on 18 sep) Indofood Agri recovered from a low of 0.390 on 26 nov, to test the 0.470 neckline (green --) today. It remains to be seen if Indofood Agri can successfully break this neckline this week.

If not, we could be looking at Indofood Agri trading between the 0.470 neckline (green --) and 0.420 support (pink --).

For monday :

Support @ 0.455 (upp pink, upp red), 0.435 (low blue), 0.420 (pink --), 0.410 (red --), 0.395 (pink ...), 0.390 (mid red)

Resistance @ 0.470 (green --), 0.495 (upp blue), 0.505 (blue ...), 0.535 (green ...), 0.575 (red ...)

If not, we could be looking at Indofood Agri trading between the 0.470 neckline (green --) and 0.420 support (pink --).

For monday :

Support @ 0.455 (upp pink, upp red), 0.435 (low blue), 0.420 (pink --), 0.410 (red --), 0.395 (pink ...), 0.390 (mid red)

Resistance @ 0.470 (green --), 0.495 (upp blue), 0.505 (blue ...), 0.535 (green ...), 0.575 (red ...)

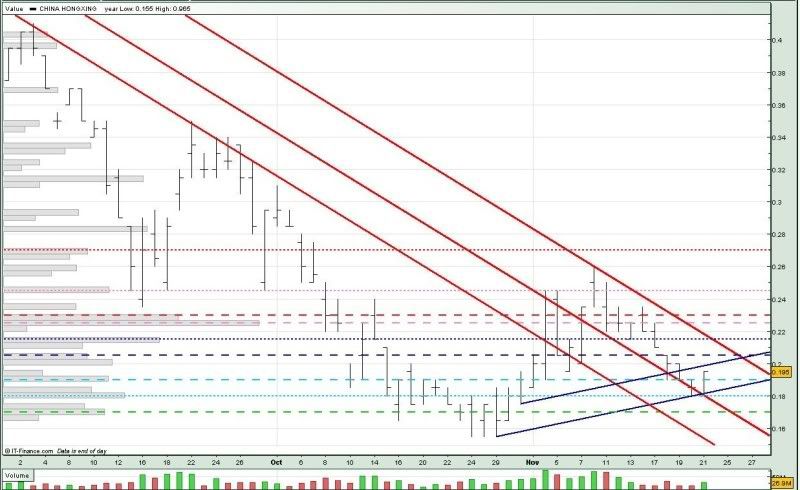

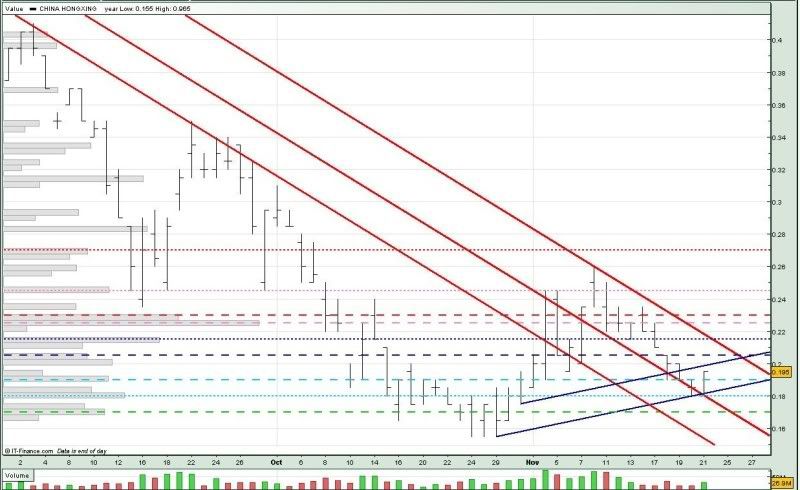

China Hongx 281108

Two days on Doji for China Hongxing, and it's being pushed further into a corner formed by the long term downtrend resistance (upp red) and uptrend support (low blue). So we might see some action for China Hongxing this week.

If China Hongxing continues to trade within the downtrend channel (red), we could see it testing the 0.170 support (green --).

For monday :

Support @ 0.190 (lightblue --), 0.180 (lightblue ...), 0.178 (low blue), 0.173 (mid red), 0.170 (green --)

Resistance @ 0.190 (upp red, lightblue --), 0.196 (upp blue), 0.200 (blue --), 0.215 (blue ...)

If China Hongxing continues to trade within the downtrend channel (red), we could see it testing the 0.170 support (green --).

For monday :

Support @ 0.190 (lightblue --), 0.180 (lightblue ...), 0.178 (low blue), 0.173 (mid red), 0.170 (green --)

Resistance @ 0.190 (upp red, lightblue --), 0.196 (upp blue), 0.200 (blue --), 0.215 (blue ...)

Saturday, November 29, 2008

A week spent tracking Wall Street, Citigroup

by R SIVANITHY (29 Nov)

A WEEK spent anticipating how Wall Street might perform later each day as well as wondering what Citigroup's fate might be. These in a nutshell are the major themes of the week just past, the other being that prices here may actually tend to lead Wall Street, rendering the Straits Times Index as possibly a better indicator of how the US market might move than even the US futures market.

Underpinning sentiment was mid-week news that the US Federal Reserve, which can basically print money if it sees fit, will extend a US$800 billion lifeline to distressed consumer debt markets to try and shore up the economy, and that the US government will essentially bail out Citigroup.

So far, Wall Street appears determined to take this as good news with its major indices responding positively, though it has to be stressed that bear rallies can appear deceivingly strong as many have turned out to be this year and there is no reason to expect this time to be any different.

Here, the Straits Times Index firmed by 70 points or 4.2 per cent over the course of the week to 1,732.57 with yesterday's session contributing 22.05 points.

Much of yesterday's gain could be attributed to month-end - and for some fund managers possibly even year-end - window dressing, while the same can possibly be said of markets everywhere.

All three banks benefited from this propping-up exercise, though DBS, despite being pushed up by 33 cents yesterday, still lost a nett 20 cents over the week at $9.40.

In a Thursday overview on Asia-Pacific banks, Merrill Lynch said it is cautious on Singapore banks because of potential negatives such as 1) slowing loan growth 2) a drop in market-related fees and 3) a cyclical rise in credit costs, all of which could depress 2009 earnings.

'The sector trades at mid-cycle valuations - 1.4x book - but that is not 'cheap' in our view given we are entering a down cycle,' said ML. It rates DBS and OCBC as 'underperform' and UOB as 'neutral'.

Keppel Corp, however, yesterday collapsed 60 cents or 12.5 per cent to $4.20 with 27 million shares traded following news that its customers are reviewing their options for $1.2 billion worth of orders.Possibly also a factor was a Wednesday downgrade by Merrill Lynch, which cited concerns about Keppel's exposure to property, oil refining and telecoms.

In a Thursday update, ML said although the impact on earnings is minimal, the news is likely to put a dent on investor confidence in the security of Keppel's current order book. 'If the sector experiences a deep and prolonged slowdown, (Thursday's) announcement is likely to be a sign of future order cancellations,' said ML. For the week, Keppel lost a nett 40 cents or 8.7 per cent.

In his weekly roundup, AMP Capital's head of investment strategy Shane Oliver, said 'while all the activity by governments around the world to get their financial markets working again and stimulate their economies won't head off the recession which is already in train, it does provide confidence that there will be an eventual economic recovery . . . While it's too early to say whether the bear market is over, there is still a good chance shares will rally into year end.'

-Research Report by R SIVANITHY (29 Nov)

A WEEK spent anticipating how Wall Street might perform later each day as well as wondering what Citigroup's fate might be. These in a nutshell are the major themes of the week just past, the other being that prices here may actually tend to lead Wall Street, rendering the Straits Times Index as possibly a better indicator of how the US market might move than even the US futures market.

Underpinning sentiment was mid-week news that the US Federal Reserve, which can basically print money if it sees fit, will extend a US$800 billion lifeline to distressed consumer debt markets to try and shore up the economy, and that the US government will essentially bail out Citigroup.

So far, Wall Street appears determined to take this as good news with its major indices responding positively, though it has to be stressed that bear rallies can appear deceivingly strong as many have turned out to be this year and there is no reason to expect this time to be any different.

Here, the Straits Times Index firmed by 70 points or 4.2 per cent over the course of the week to 1,732.57 with yesterday's session contributing 22.05 points.

Much of yesterday's gain could be attributed to month-end - and for some fund managers possibly even year-end - window dressing, while the same can possibly be said of markets everywhere.

All three banks benefited from this propping-up exercise, though DBS, despite being pushed up by 33 cents yesterday, still lost a nett 20 cents over the week at $9.40.

In a Thursday overview on Asia-Pacific banks, Merrill Lynch said it is cautious on Singapore banks because of potential negatives such as 1) slowing loan growth 2) a drop in market-related fees and 3) a cyclical rise in credit costs, all of which could depress 2009 earnings.

'The sector trades at mid-cycle valuations - 1.4x book - but that is not 'cheap' in our view given we are entering a down cycle,' said ML. It rates DBS and OCBC as 'underperform' and UOB as 'neutral'.

Keppel Corp, however, yesterday collapsed 60 cents or 12.5 per cent to $4.20 with 27 million shares traded following news that its customers are reviewing their options for $1.2 billion worth of orders.Possibly also a factor was a Wednesday downgrade by Merrill Lynch, which cited concerns about Keppel's exposure to property, oil refining and telecoms.

In a Thursday update, ML said although the impact on earnings is minimal, the news is likely to put a dent on investor confidence in the security of Keppel's current order book. 'If the sector experiences a deep and prolonged slowdown, (Thursday's) announcement is likely to be a sign of future order cancellations,' said ML. For the week, Keppel lost a nett 40 cents or 8.7 per cent.

In his weekly roundup, AMP Capital's head of investment strategy Shane Oliver, said 'while all the activity by governments around the world to get their financial markets working again and stimulate their economies won't head off the recession which is already in train, it does provide confidence that there will be an eventual economic recovery . . . While it's too early to say whether the bear market is over, there is still a good chance shares will rally into year end.'

-Research Report by R SIVANITHY (29 Nov)

Quiet session ahead of Wall St closure

by R SIVANITHY (28 Nov)

Local stocks likely sold on event after having been bought in anticipation of US Wednesday rally

THERE are two features of interest associated with yesterday's 0.61- point drop in the Straits Times Index (STI) to 1,710.52. First, the strong likelihood that investors 'bought in anticipation and sold on news' - on Wednesday, the Straits Times Index jumped almost 60 points, of which 40 came in the final few minutes because of sudden expectations that Wall Street would rally that day.

Because a rally did materialise and possibly because the US market is closed on Thursday for Thanksgiving, this then provided the cue to sell, with the STI falling at one point almost 20 points into negative territory.

Second, the fact that Wall Street rose on Wednesday as expected confirms a long-held view expressed in this column that program trading targets this part of the world ahead of the US - the correlation between movements in the STI and the Dow Jones Industrial Average on any given day has been near-perfect for several months now.

Whether this is thanks to synchronised short-covering or whether the STI is singled out for special treatment because of the ease with which it can be manipulated are matters for conjecture; suffice to say that there can be little doubt that as an advance indicator of how US stocks might perform later on any day, the STI's movements are possibly an even better indicator than the US futures market.

Turnover continued to hover below the $1 billion mark, a threshold loosely defined as signifying thin trading. Excluding foreign currency issues, 1.1 billion units worth $952 million were done, the low unit value suggesting penny stocks were more in demand than the larger-cap blue chips.

Among the actives was China shipyard Cosco Corp, a company that could do no wrong last year but one that has fallen on tough times lately.

In downgrading Cosco to 'underperform', Merrill Lynch (ML) in a Nov 26 report said the outlook for order cancellations combined with a sharp drop in the Baltic Dry Index are now painting a more negative outlook for the shipping industry than previously anticipated.

'We cut Cosco's order book by 25 per cent to account for potential order cancellations, reduce our order wins assumptions and reduce our freight rates ... and reduce our price objective to 55 cents a share. We have also cut our FY08-10 earnings estimates by an average of 25 per cent,' said ML.

Cosco yesterday was unchanged at 71.5 cents with 25 million shares traded.

The US investment bank also downgraded Keppel Corp from 'buy' to 'neutral'. In a Nov 26 report, it said the risks associated with Keppel's subsidiary and associate earnings will continue to be a drag on its shares.

'ML Singapore property analysts are not ready to call the bottom for property stocks as the economic outlook remains depressed. Valuation metrics are extremely volatile as the economic climate continues to deteriorate, while we see no catalyst to sustain a re-rating in stock prices,' said ML. Keppel yesterday rose six cents to $4.80 with 8.2 million units done.

In its latest assessment of US economic data, Ideaglobal said there have been signs of weakness for some time but recent events in financial markets have made a bad situation significantly worse.

'At this point, there is no debating whether or not we are in a recession, it has now transformed into a question of how deep and painful it will become,' said Ideaglobal.

-Research Report by R SIVANITHY (28 Nov)

Local stocks likely sold on event after having been bought in anticipation of US Wednesday rally

THERE are two features of interest associated with yesterday's 0.61- point drop in the Straits Times Index (STI) to 1,710.52. First, the strong likelihood that investors 'bought in anticipation and sold on news' - on Wednesday, the Straits Times Index jumped almost 60 points, of which 40 came in the final few minutes because of sudden expectations that Wall Street would rally that day.

Because a rally did materialise and possibly because the US market is closed on Thursday for Thanksgiving, this then provided the cue to sell, with the STI falling at one point almost 20 points into negative territory.

Second, the fact that Wall Street rose on Wednesday as expected confirms a long-held view expressed in this column that program trading targets this part of the world ahead of the US - the correlation between movements in the STI and the Dow Jones Industrial Average on any given day has been near-perfect for several months now.

Whether this is thanks to synchronised short-covering or whether the STI is singled out for special treatment because of the ease with which it can be manipulated are matters for conjecture; suffice to say that there can be little doubt that as an advance indicator of how US stocks might perform later on any day, the STI's movements are possibly an even better indicator than the US futures market.

Turnover continued to hover below the $1 billion mark, a threshold loosely defined as signifying thin trading. Excluding foreign currency issues, 1.1 billion units worth $952 million were done, the low unit value suggesting penny stocks were more in demand than the larger-cap blue chips.

Among the actives was China shipyard Cosco Corp, a company that could do no wrong last year but one that has fallen on tough times lately.

In downgrading Cosco to 'underperform', Merrill Lynch (ML) in a Nov 26 report said the outlook for order cancellations combined with a sharp drop in the Baltic Dry Index are now painting a more negative outlook for the shipping industry than previously anticipated.

'We cut Cosco's order book by 25 per cent to account for potential order cancellations, reduce our order wins assumptions and reduce our freight rates ... and reduce our price objective to 55 cents a share. We have also cut our FY08-10 earnings estimates by an average of 25 per cent,' said ML.

Cosco yesterday was unchanged at 71.5 cents with 25 million shares traded.

The US investment bank also downgraded Keppel Corp from 'buy' to 'neutral'. In a Nov 26 report, it said the risks associated with Keppel's subsidiary and associate earnings will continue to be a drag on its shares.

'ML Singapore property analysts are not ready to call the bottom for property stocks as the economic outlook remains depressed. Valuation metrics are extremely volatile as the economic climate continues to deteriorate, while we see no catalyst to sustain a re-rating in stock prices,' said ML. Keppel yesterday rose six cents to $4.80 with 8.2 million units done.

In its latest assessment of US economic data, Ideaglobal said there have been signs of weakness for some time but recent events in financial markets have made a bad situation significantly worse.

'At this point, there is no debating whether or not we are in a recession, it has now transformed into a question of how deep and painful it will become,' said Ideaglobal.

-Research Report by R SIVANITHY (28 Nov)

Thursday, November 27, 2008

Late surge in anticipation of US rally

by R SIVANITHY (27 Nov)

ST Index closes 58 points higher, but broad market shows only 159 rises versus 137 falls

JUDGING by the Straits Times Index's (STI) 57.88- point rise to 1,711.13 yesterday - the bulk of which came in the final five minutes - program traders were positioning themselves for an expected Wall Street rally later in the day.

The broad market, however, did not fare as well as the index. Excluding STI components and warrants, there were only 159 rises versus 137 falls in the wider market.

The STI owed much of its last-minute gain to a 16-cent rise in SingTel that accounted for 17 points. Of this, 10 cents came in the post-closing adjustment period between 5-5.05pm.

Brokers continued to speak of caution among clients and this was reflected in low volume. Excluding foreign currency issues, only 864 million units worth $931 million were traded.

Among banks, DBS first fell to $9.01 but ended unchanged at $9.20, while UOB's 70-cent jump to $12.60 added 11 points to the index. Brokers speculated that investors were switching from one to the other, possibly because of fears that DBS might call for a rights issue, worries that have arisen because Standard Chartered Bank recently announced a rights issue.

In the second line, Jade Technologies' shares, which cost 30 cents this time last year, closed half a cent lower at 1.5 cents. The company on Tuesday reported a $39 million loss for the full year ended Sept 30. At 1.5 cents a share, Jade's market capitalisation is about $17 million.

Most trading activity was focused on battered commodity plays like Golden Agri, Indofood Agri and Olam International, as well as China stocks that have collapsed significantly from their highs such as China Hongxing, Cosco and Yanlord.

Elsewhere, Bright World's shares lost three cents to 24.5 cents after news that the Monetary Authority of Singapore has written to the company about a possible breach of the Securities and Futures Act.

In a report on the telco sector, OCBC Investment Research said: 'Going into 2009, the whole stock market will continue to face many challenges, most of them coming from the macroeconomic front.

In such a highly unpredictable climate, we believe that a flight to quality is not enough - investors should also focus on defensiveness of earnings as well as sustainable dividend payout abilities and Singapore's telcos meet these criteria. As such, we continue to maintain our 'overweight' rating on the sector.

'While earnings are expected to take a slight knock next year due to the recession, we do not expect the slowdown to have much of an impact, if any, on the telcos' healthy operating cashflows. If anything, we expect more prudent capex spending and other cost-reduction measures to further improve operating cashflows and, in turn, sustain the already attractive dividend policies.'

In its 2009 Outlook report, ratings agency Standard & Poor's (S&P) said that for Asia-Pacific equity markets, a rebound is likely in 2009.

Its director of research Lorraine Tan believes markets are in the process of bottoming. 'Although the economic and corporate news is likely to remain negative - and uncertainty still pervades the global financial system - we see that markets will have retraced in line with, and in some cases exceeded, movements in previous bear markets in terms of both value and time frame,' said Ms Tan.

S&P also said 'ongoing market dislocation will significantly impact Asia-Pacific in 2009, but factors such as intra-regional trade, supportive policy-making, and still-robust forecasts for China and India will help the region navigate the global storm'.

-Research Report by R SIVANITHY (27 Nov)

ST Index closes 58 points higher, but broad market shows only 159 rises versus 137 falls

JUDGING by the Straits Times Index's (STI) 57.88- point rise to 1,711.13 yesterday - the bulk of which came in the final five minutes - program traders were positioning themselves for an expected Wall Street rally later in the day.

The broad market, however, did not fare as well as the index. Excluding STI components and warrants, there were only 159 rises versus 137 falls in the wider market.

The STI owed much of its last-minute gain to a 16-cent rise in SingTel that accounted for 17 points. Of this, 10 cents came in the post-closing adjustment period between 5-5.05pm.

Brokers continued to speak of caution among clients and this was reflected in low volume. Excluding foreign currency issues, only 864 million units worth $931 million were traded.

Among banks, DBS first fell to $9.01 but ended unchanged at $9.20, while UOB's 70-cent jump to $12.60 added 11 points to the index. Brokers speculated that investors were switching from one to the other, possibly because of fears that DBS might call for a rights issue, worries that have arisen because Standard Chartered Bank recently announced a rights issue.

In the second line, Jade Technologies' shares, which cost 30 cents this time last year, closed half a cent lower at 1.5 cents. The company on Tuesday reported a $39 million loss for the full year ended Sept 30. At 1.5 cents a share, Jade's market capitalisation is about $17 million.

Most trading activity was focused on battered commodity plays like Golden Agri, Indofood Agri and Olam International, as well as China stocks that have collapsed significantly from their highs such as China Hongxing, Cosco and Yanlord.

Elsewhere, Bright World's shares lost three cents to 24.5 cents after news that the Monetary Authority of Singapore has written to the company about a possible breach of the Securities and Futures Act.

In a report on the telco sector, OCBC Investment Research said: 'Going into 2009, the whole stock market will continue to face many challenges, most of them coming from the macroeconomic front.

In such a highly unpredictable climate, we believe that a flight to quality is not enough - investors should also focus on defensiveness of earnings as well as sustainable dividend payout abilities and Singapore's telcos meet these criteria. As such, we continue to maintain our 'overweight' rating on the sector.

'While earnings are expected to take a slight knock next year due to the recession, we do not expect the slowdown to have much of an impact, if any, on the telcos' healthy operating cashflows. If anything, we expect more prudent capex spending and other cost-reduction measures to further improve operating cashflows and, in turn, sustain the already attractive dividend policies.'

In its 2009 Outlook report, ratings agency Standard & Poor's (S&P) said that for Asia-Pacific equity markets, a rebound is likely in 2009.

Its director of research Lorraine Tan believes markets are in the process of bottoming. 'Although the economic and corporate news is likely to remain negative - and uncertainty still pervades the global financial system - we see that markets will have retraced in line with, and in some cases exceeded, movements in previous bear markets in terms of both value and time frame,' said Ms Tan.

S&P also said 'ongoing market dislocation will significantly impact Asia-Pacific in 2009, but factors such as intra-regional trade, supportive policy-making, and still-robust forecasts for China and India will help the region navigate the global storm'.

-Research Report by R SIVANITHY (27 Nov)

Labels:

China Hongxing,

Cosco,

Editorial Reports,

IndoAgri,

Olam,

STIndex

Wednesday, November 26, 2008

Investors continue to sell into strength

by R SIVANITHY (26 Nov)

SELLING into strength has been the preferred strategy over the past year and so it was again yesterday - the Straits Times Index first shot up 70 points in response to Monday's Wall Street rally but eventually closed just 32.96 points up at 1,653.25. It stood at 1,640 at 5pm but gained about 12 points in the post-closing adjustment period, mainly through a last-minute push on DBS and Keppel Corp.

The broad market was much more mixed than the index's reading would suggest - excluding foreign currency stocks, warrants and STI components, there were only 150 rises versus 148 falls.

Talk to dealers and the picture they would paint about the state of the local stock market remains the same as it has been for months now - stocks remain trapped within narrow bands with rallies viewed as bear traps and volume dwindling as a result.

Further afield there was worry that although the US government is bailing out Citigroup - news of which propelled Wall Street on Monday - there may be more large-scale failures yet to come in both the financial and motor industries.

As always, the local index's fortunes were dictated by Hong Kong, where the Hang Seng was firm throughout the day but was unable to add significantly to its 4 per cent gain that was attained early in the morning.

Among blue chips it was the banks which led the way, though all were off their highs. Similarly, SingTel rose 7 cents to $2.55 in the morning but finished one cent weaker at $2.47.

DMG Research said in a chart view on the STI that it believes a break below the 1,600-1,717 region implies the the index is headed for the 1,391 level by January. 'As for our weekly short-term view for the STI, we believe any rebounds should be short-lived. . .additionally, the 14-day RSI (relative strength index) still hovering above the 30 level also suggests that the STI is not yet oversold. Support is set at the 1,570-1,580 area. . .' said DMG.

In its Weekly Flow Investment Strategy Update dated Nov 20, Merrill Lynch said cash is king for now. 'But it's getting cheaper and cheaper: a typical US money market fund yields 0.73 per cent, meaning it would now take 95 years to double your money in it.'

It says it believes that among the catalysts cash-heavy investors are waiting for are lower volatility and spreads and the completion of big EPS downgrades. February is the earliest one can envisage all of them coinciding.

Meantime, investors were urged to watch credit spreads, for signs of credit-crunch easing, inventories for signs that the violent collapse in economic momentum is ending and A-shares, for signs that Chinese policy stimulus is working.

In its latest Economics & Strategy report dated Monday, Henderson Global Investors said that it is inherently difficult to call market bottoms but one signal is to look for the trend in leading economic indicators (LEIs).

'Plunging business and consumer confidence suggest the US, UK, Euro-zone and Japanese economies will experience a severe recession. . .the rapid deterioration in the economic outlook for Europe and the UK is likely to lead to more interest rate cuts in the coming months.'

Henderson also said recessions and periods of de-leveraging are almost always associated with falling inflation. However, the risk of headline deflation has increased substantially, said Henderson.

-Research Report by R SIVANITHY (26 Nov)

SELLING into strength has been the preferred strategy over the past year and so it was again yesterday - the Straits Times Index first shot up 70 points in response to Monday's Wall Street rally but eventually closed just 32.96 points up at 1,653.25. It stood at 1,640 at 5pm but gained about 12 points in the post-closing adjustment period, mainly through a last-minute push on DBS and Keppel Corp.

The broad market was much more mixed than the index's reading would suggest - excluding foreign currency stocks, warrants and STI components, there were only 150 rises versus 148 falls.

Talk to dealers and the picture they would paint about the state of the local stock market remains the same as it has been for months now - stocks remain trapped within narrow bands with rallies viewed as bear traps and volume dwindling as a result.

Further afield there was worry that although the US government is bailing out Citigroup - news of which propelled Wall Street on Monday - there may be more large-scale failures yet to come in both the financial and motor industries.

As always, the local index's fortunes were dictated by Hong Kong, where the Hang Seng was firm throughout the day but was unable to add significantly to its 4 per cent gain that was attained early in the morning.

Among blue chips it was the banks which led the way, though all were off their highs. Similarly, SingTel rose 7 cents to $2.55 in the morning but finished one cent weaker at $2.47.

DMG Research said in a chart view on the STI that it believes a break below the 1,600-1,717 region implies the the index is headed for the 1,391 level by January. 'As for our weekly short-term view for the STI, we believe any rebounds should be short-lived. . .additionally, the 14-day RSI (relative strength index) still hovering above the 30 level also suggests that the STI is not yet oversold. Support is set at the 1,570-1,580 area. . .' said DMG.

In its Weekly Flow Investment Strategy Update dated Nov 20, Merrill Lynch said cash is king for now. 'But it's getting cheaper and cheaper: a typical US money market fund yields 0.73 per cent, meaning it would now take 95 years to double your money in it.'

It says it believes that among the catalysts cash-heavy investors are waiting for are lower volatility and spreads and the completion of big EPS downgrades. February is the earliest one can envisage all of them coinciding.

Meantime, investors were urged to watch credit spreads, for signs of credit-crunch easing, inventories for signs that the violent collapse in economic momentum is ending and A-shares, for signs that Chinese policy stimulus is working.

In its latest Economics & Strategy report dated Monday, Henderson Global Investors said that it is inherently difficult to call market bottoms but one signal is to look for the trend in leading economic indicators (LEIs).

'Plunging business and consumer confidence suggest the US, UK, Euro-zone and Japanese economies will experience a severe recession. . .the rapid deterioration in the economic outlook for Europe and the UK is likely to lead to more interest rate cuts in the coming months.'

Henderson also said recessions and periods of de-leveraging are almost always associated with falling inflation. However, the risk of headline deflation has increased substantially, said Henderson.

-Research Report by R SIVANITHY (26 Nov)

Tuesday, November 25, 2008

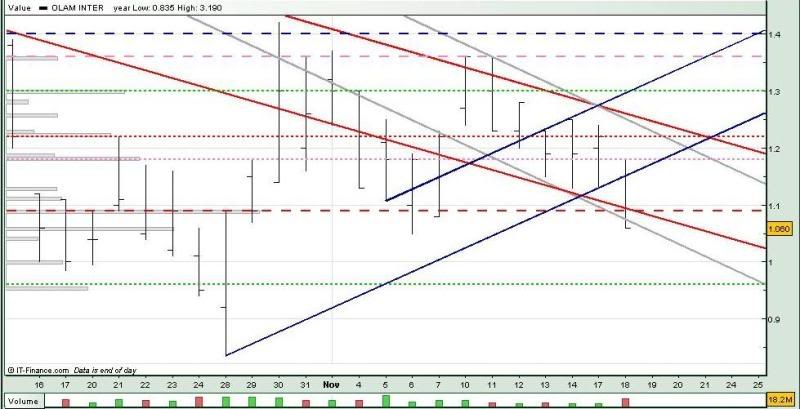

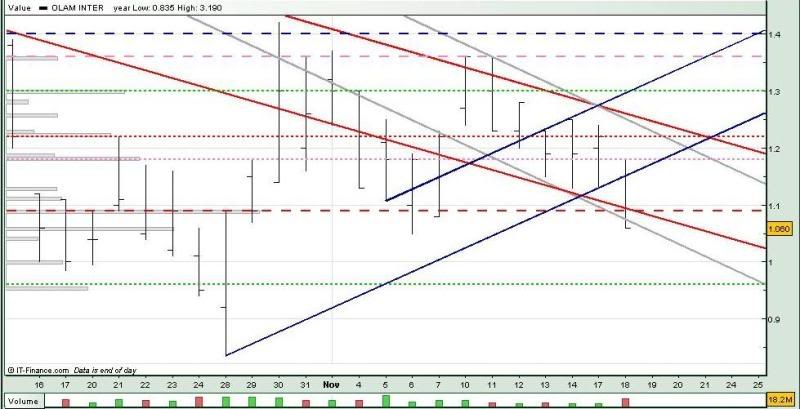

Olam 251108

After opening above the downtrend resistance (mid grey), Olam weakened quickly and broke the 0.960 support (green ...) and 0.930 support (green --). Olam closed right on the 0.900 support (pink --). Moreover, today's break down was accompanied with volume.

The last time Olam traded below the 0.900 level was on 28 oct (0.835 low). If Olam breaks the 0.900 support, we could see it revisit this low. Would that have completed the double-bottom formation?

For tomorrow :

Support @ 0.900 (pink --), 0.835 (28 oct low), 0.813 (low grey)

Resistance @ 0.930 (green --), 0.945 (mid grey), 0.960 (green ...), 1.00 (blue --), 1.015 (low red)

The last time Olam traded below the 0.900 level was on 28 oct (0.835 low). If Olam breaks the 0.900 support, we could see it revisit this low. Would that have completed the double-bottom formation?

For tomorrow :

Support @ 0.900 (pink --), 0.835 (28 oct low), 0.813 (low grey)

Resistance @ 0.930 (green --), 0.945 (mid grey), 0.960 (green ...), 1.00 (blue --), 1.015 (low red)

Noble Group 251108

Noble Group continues to trade within the uptrend channel (blue), even testing the 0.795 neckline (pink --), uptrend resistance (mid blue), and downtrend resistance (mid pink), before ending the day below the long term downtrend resistance (low red).

Based on the volume distribution bars on the left, Noble Group also seems to have build up quite a support base at the 0.740 level (pink ...). However, we could see this base being severely tested in the next few days.

If Noble Group manages to hold onto this support, we could see attempt to break the 0.795 resistance (pink --) again. However, if Noble Group breaks the downtrend support (low pink), we could see it test the 0.685 support (red --).

For tomorrow :

Support @ 0.740 (pink ...), 0.7185 (low pink), 0.705 (low blue), 0.685 (red --)

Resistance @ 0.760 (low red), 0.795 (pink --), 0.803 (mid pink), 0.820 (mid blue), 0.855 (blue ...)

Based on the volume distribution bars on the left, Noble Group also seems to have build up quite a support base at the 0.740 level (pink ...). However, we could see this base being severely tested in the next few days.

If Noble Group manages to hold onto this support, we could see attempt to break the 0.795 resistance (pink --) again. However, if Noble Group breaks the downtrend support (low pink), we could see it test the 0.685 support (red --).

For tomorrow :

Support @ 0.740 (pink ...), 0.7185 (low pink), 0.705 (low blue), 0.685 (red --)

Resistance @ 0.760 (low red), 0.795 (pink --), 0.803 (mid pink), 0.820 (mid blue), 0.855 (blue ...)

Indofood Agri 251108

There was joy (for the longists) initially when Indofoor Agri opened on the 0.420 neckline (pink --), breaking the long term downtrend resistance (upp pink) at the same time. Indofood Agri even came close to testing the downtrend resistance (mid red).

However, as the day went on, things began to take a turn for the worse when Indofood Agri began reversing, giving up its gains, breaking the 0.420 and 0.410 necklines. Indofood Agri then finished the day by closing right on the 0.395 support (pink ...).

If Indofood Agri breaks the 0.395 support, we could see it testing the end oct lows of 0.375 (blue --) again.

For tomorrow :

Support @ 0.395 (pink ...), 0.375 (upp pink, blue --), 0.370 (low red), 0.315 (mid pink)

Resistance @ 0.410 (red --), 0.420 (pink --), 0.425 (mid red), 0.470 (green --), 0.495 (upp red)

However, as the day went on, things began to take a turn for the worse when Indofood Agri began reversing, giving up its gains, breaking the 0.420 and 0.410 necklines. Indofood Agri then finished the day by closing right on the 0.395 support (pink ...).

If Indofood Agri breaks the 0.395 support, we could see it testing the end oct lows of 0.375 (blue --) again.

For tomorrow :

Support @ 0.395 (pink ...), 0.375 (upp pink, blue --), 0.370 (low red), 0.315 (mid pink)

Resistance @ 0.410 (red --), 0.420 (pink --), 0.425 (mid red), 0.470 (green --), 0.495 (upp red)

Cosco 251108

Could Cosco be forming a double-bottom? Although Cosco has not broken the 0.755 resistance (blue ...) yet, it managed to keep off the uptrend support (low blue) and 0.670 support (pink --) these 2 days.

We could see some action for Cosco towards the end of the week when the long term downtrend resistance (mid pink) meets the uptrend support (low blue) and 0.670 support (pink --).

If Cosco breaks these 2 supports, we could see Cosco re-vsiting 3-year lows.

For tomorrow :

Support @ 0.670 (low blue, pink --), 0.600 (low pink)

Resistance @ 0.730 (min pink), 0.755 (blue ...), 0.785 (upp blue), 0.795 (green ...), 0.815 (red --)

We could see some action for Cosco towards the end of the week when the long term downtrend resistance (mid pink) meets the uptrend support (low blue) and 0.670 support (pink --).

If Cosco breaks these 2 supports, we could see Cosco re-vsiting 3-year lows.

For tomorrow :

Support @ 0.670 (low blue, pink --), 0.600 (low pink)

Resistance @ 0.730 (min pink), 0.755 (blue ...), 0.785 (upp blue), 0.795 (green ...), 0.815 (red --)

China Hongx 251108

China Hongxing continues to trade (more or less) between the 0.180 support (lightblue ...) and 0.190 resistance (lightblue --), probably trying to form a base. However, China Hongxing has been closing low the last 2 days, So I'm not sure how long more the 0.180 support can hold.

If the support breaks, the selling could come fast and furious, and China Hongxing could re-test the end oct lows.

For tomorrow :

Support @ 0.180 (low blue, lightblue ...), 0.170 (green --), 0.165 (mid red), 0.140 (low red)

Resistance @ 0.190 (lightblue --), 0.197 (upp blue), 0.200 (blue --), 0.205 (upp red)

If the support breaks, the selling could come fast and furious, and China Hongxing could re-test the end oct lows.

For tomorrow :

Support @ 0.180 (low blue, lightblue ...), 0.170 (green --), 0.165 (mid red), 0.140 (low red)

Resistance @ 0.190 (lightblue --), 0.197 (upp blue), 0.200 (blue --), 0.205 (upp red)

Market starts week on weak note

by CONRAD TAN (25 Nov)

UOB and DBS are main drags on STI; gains by heavyweights SingTel and KepCorp help limit index's losses

STOCKS here started the week on a sour note yesterday as two of the world's biggest banks scrambled to raise capital, adding to fears that the unfolding economic crisis worldwide is taking its toll on even the biggest names.

The Straits Times Index (STI) finished 41.81 points or 2.5 per cent lower at 1,620.29, after slumping 2.6 per cent earlier in the day. United Overseas Bank (UOB) and DBS Group were the main drags on the index.

Around the region, bank stocks suffered after Standard Chartered Bank said it would raise £1.8 billion (S$4.1 billion) through a rights issue to boost its capital base and the US government agreed to bail out Citigroup by injecting US$20 billion into it and insuring up to US$306 billion of its troubled assets.

Here, UOB finished 3.8 per cent lower at $11.26, DBS fell 3.4 per cent to $9.27 and OCBC Bank ended 1.1 per cent down at $4.55.

In a report yesterday, DBS analysts said they remain 'cautious' on the local banking sector, despite the boost from the government's initiative announced last week to support lending to small and medium-size enterprises (SMEs).

'We believe this move by the government will ease credit worries, alleviate default risk of SMEs and restore confidence in the availability of credit to SMEs,' they said. Still, 'the key concerns ahead would be the extent of asset quality weakness the banks might face'.

Olam International, a supplier of agricultural commodities worldwide, led yesterday's blue-chip declines in percentage terms. It fell 7 per cent to 93 cents, revisiting last Wednesday's low. The stock has slumped 66.9 per cent this year amid a broader slide in commodity-related stocks, as the world's biggest economies tip into recession, hurting demand for a range of commodities.

But Hong Kong-based Noble Group, which manages global supply chains in food, energy and metals, defied the broader market yesterday, rising 0.7 per cent to 74.5 cents after slumping badly last week. For the year, the stock is still down 63.2 per cent.

Chinese shipyard operator Cosco Corp was the second-biggest loser in percentage terms among STI members, falling 6.8 per cent to 68 cents.

Of the STI's 30 component stocks, 25 fell, four rose and one finished unchanged. Index heavyweights SingTel and Keppel Corp were among the gainers, which helped limit the STI's losses. SingTel rose 1.2 per cent to $2.48 and KepCorp finished 0.2 per cent higher at $4.61.

Outside the STI, the broader market was also weak. Losing counters outnumbered gainers 284-108 overall, with 930 counters unchanged, excluding warrants and bonds. Trading volume was abysmally low.

Just 790.4 million units worth $650.3 million changed hands, compared with Friday's volume of 1.17 billion units worth $971.6 million. That includes warrants and bonds but excludes shares traded in foreign currencies.

CapitaCommercial Trust fell 8.2 per cent to 73 cents after the property trust said on Friday it was pursuing its refinancing needs with several financial institutions. A Reuters report that day suggested the trust had asked four banks to arrange $580 million in refinancing.

The FTSE ST All-Share index, which tracks 268 of the most liquid stocks listed here, fell 2.5 per cent yesterday, while the UOB Catalist index of stocks on the second board dipped 1.5 per cent.

Elsewhere in the region, most stock indices also ended lower, except in Japan where markets were closed for a public holiday. Hong Kong's Hang Seng Index slid 1.6 per cent.

-Research Report by CONRAD TAN (25 Nov)

UOB and DBS are main drags on STI; gains by heavyweights SingTel and KepCorp help limit index's losses

STOCKS here started the week on a sour note yesterday as two of the world's biggest banks scrambled to raise capital, adding to fears that the unfolding economic crisis worldwide is taking its toll on even the biggest names.

The Straits Times Index (STI) finished 41.81 points or 2.5 per cent lower at 1,620.29, after slumping 2.6 per cent earlier in the day. United Overseas Bank (UOB) and DBS Group were the main drags on the index.

Around the region, bank stocks suffered after Standard Chartered Bank said it would raise £1.8 billion (S$4.1 billion) through a rights issue to boost its capital base and the US government agreed to bail out Citigroup by injecting US$20 billion into it and insuring up to US$306 billion of its troubled assets.

Here, UOB finished 3.8 per cent lower at $11.26, DBS fell 3.4 per cent to $9.27 and OCBC Bank ended 1.1 per cent down at $4.55.

In a report yesterday, DBS analysts said they remain 'cautious' on the local banking sector, despite the boost from the government's initiative announced last week to support lending to small and medium-size enterprises (SMEs).

'We believe this move by the government will ease credit worries, alleviate default risk of SMEs and restore confidence in the availability of credit to SMEs,' they said. Still, 'the key concerns ahead would be the extent of asset quality weakness the banks might face'.

Olam International, a supplier of agricultural commodities worldwide, led yesterday's blue-chip declines in percentage terms. It fell 7 per cent to 93 cents, revisiting last Wednesday's low. The stock has slumped 66.9 per cent this year amid a broader slide in commodity-related stocks, as the world's biggest economies tip into recession, hurting demand for a range of commodities.

But Hong Kong-based Noble Group, which manages global supply chains in food, energy and metals, defied the broader market yesterday, rising 0.7 per cent to 74.5 cents after slumping badly last week. For the year, the stock is still down 63.2 per cent.

Chinese shipyard operator Cosco Corp was the second-biggest loser in percentage terms among STI members, falling 6.8 per cent to 68 cents.

Of the STI's 30 component stocks, 25 fell, four rose and one finished unchanged. Index heavyweights SingTel and Keppel Corp were among the gainers, which helped limit the STI's losses. SingTel rose 1.2 per cent to $2.48 and KepCorp finished 0.2 per cent higher at $4.61.

Outside the STI, the broader market was also weak. Losing counters outnumbered gainers 284-108 overall, with 930 counters unchanged, excluding warrants and bonds. Trading volume was abysmally low.

Just 790.4 million units worth $650.3 million changed hands, compared with Friday's volume of 1.17 billion units worth $971.6 million. That includes warrants and bonds but excludes shares traded in foreign currencies.

CapitaCommercial Trust fell 8.2 per cent to 73 cents after the property trust said on Friday it was pursuing its refinancing needs with several financial institutions. A Reuters report that day suggested the trust had asked four banks to arrange $580 million in refinancing.

The FTSE ST All-Share index, which tracks 268 of the most liquid stocks listed here, fell 2.5 per cent yesterday, while the UOB Catalist index of stocks on the second board dipped 1.5 per cent.

Elsewhere in the region, most stock indices also ended lower, except in Japan where markets were closed for a public holiday. Hong Kong's Hang Seng Index slid 1.6 per cent.

-Research Report by CONRAD TAN (25 Nov)

Labels:

Cosco,

Noble Group,

Olam,

Research Reports,

STIndex

STI likely to consolidate further

by Ken Tai Chee Ming, CMT senior technical strategist, KELIVE RESEARCH (25 Nov)

BASED on Elliot Wave theorem, the Straits Times Index is currently trending in Wave-B downtrend of its Wave-4 cycle. At the macro front, the decline in commodity and oil prices is making a positive impact on the US external deficit and US dollar strength.

Coupled with the rising aversion to global risk, there is anecdotal evidence to suggest that US capital outflow to Asia is slowing down somewhat as funds re-balance their weightings in favour of US dollar assets.

If this prognosis is accurate, then Asian markets will likely consolidate further as the US dollar strengthens. For Singapore, MAS's shift towards a zero appreciation policy for the Sing dollar on Oct 9 had led to speculative shorts on the Sing dollar.

To date, the Sing dollar/US dollar exchange rate has depreciated from $1.47 to $1.53; the next resistance to watch is $1.543, followed by $1.592. We believe currency exchange levels will have a deterministic role in this phase of the STI's consolidation with index support at 1,570.

While it could be a wait before the Wave-C rebound arrives, potentially, a breakout of the recent 1,933 high achieved this October is plausible.

-Research Report by Ken Tai Chee Ming, CMT senior technical strategist, KELIVE RESEARCH (25 Nov)

BASED on Elliot Wave theorem, the Straits Times Index is currently trending in Wave-B downtrend of its Wave-4 cycle. At the macro front, the decline in commodity and oil prices is making a positive impact on the US external deficit and US dollar strength.

Coupled with the rising aversion to global risk, there is anecdotal evidence to suggest that US capital outflow to Asia is slowing down somewhat as funds re-balance their weightings in favour of US dollar assets.

If this prognosis is accurate, then Asian markets will likely consolidate further as the US dollar strengthens. For Singapore, MAS's shift towards a zero appreciation policy for the Sing dollar on Oct 9 had led to speculative shorts on the Sing dollar.

To date, the Sing dollar/US dollar exchange rate has depreciated from $1.47 to $1.53; the next resistance to watch is $1.543, followed by $1.592. We believe currency exchange levels will have a deterministic role in this phase of the STI's consolidation with index support at 1,570.

While it could be a wait before the Wave-C rebound arrives, potentially, a breakout of the recent 1,933 high achieved this October is plausible.

-Research Report by Ken Tai Chee Ming, CMT senior technical strategist, KELIVE RESEARCH (25 Nov)

Technical view on ST Index

by DMG AND PARTNERS SECURITIES (25 Nov)

STRAITS Times Index (STI): Edging closer to the 1,391 level.

We have previously noted that the STI is set to fall due to the Symmetrical Triangle pattern that had formed. While the STI did eventually drop 10.7 per cent to its intraday low of 1,570 during the previous week, we had underestimated the magnitude of the decline as we had expected the index to 'consolidate with a bearish tone' - the breakout move out of the Triangle had taken place slightly earlier than we have anticipated.

We had also mentioned that the break below the 1,600-1,717 region would imply that the index is set to target the 1,391 mark to complete the 161.8 per cent move of Wave A. While this view remains and with the STI still in the midst of a Wave C, we now note that this level should be attained by January.

As for our weekly short-term view for the STI, we believe that any rebounds should be shortlived. With the potential bearish moving average crossover on the MACD chart looming, the breakout move from the Triangle looks poised to continue. Additionally, the 14-day RSI is still hovering above the 30 level, suggesting that the STI is not yet oversold.

Support is set at the 1,570-1,580 area which is in line with the lower bollinger band while resistance is derived at the 1,760-1,770 range as depicted by the confluence of the 14- and 21-day moving averages.

-Research Report by DMG AND PARTNERS SECURITIES (25 Nov)

STRAITS Times Index (STI): Edging closer to the 1,391 level.

We have previously noted that the STI is set to fall due to the Symmetrical Triangle pattern that had formed. While the STI did eventually drop 10.7 per cent to its intraday low of 1,570 during the previous week, we had underestimated the magnitude of the decline as we had expected the index to 'consolidate with a bearish tone' - the breakout move out of the Triangle had taken place slightly earlier than we have anticipated.

We had also mentioned that the break below the 1,600-1,717 region would imply that the index is set to target the 1,391 mark to complete the 161.8 per cent move of Wave A. While this view remains and with the STI still in the midst of a Wave C, we now note that this level should be attained by January.

As for our weekly short-term view for the STI, we believe that any rebounds should be shortlived. With the potential bearish moving average crossover on the MACD chart looming, the breakout move from the Triangle looks poised to continue. Additionally, the 14-day RSI is still hovering above the 30 level, suggesting that the STI is not yet oversold.

Support is set at the 1,570-1,580 area which is in line with the lower bollinger band while resistance is derived at the 1,760-1,770 range as depicted by the confluence of the 14- and 21-day moving averages.

-Research Report by DMG AND PARTNERS SECURITIES (25 Nov)

The End Is Near?

Is the market finally turning around? Depends on how you look at it. Saw this cartoon on Newsweek. Really sums up the situation now.

Different people, different perspectives.

Different people, different perspectives.

Different people, different perspectives.

Different people, different perspectives.

Monday, November 24, 2008

More than just rig builders

by VINCENT WEE (24 Nov)

LOOKING at the one-year price charts of SembCorp Marine, Keppel Corp and the benchmark crude oil grade, a close correlation appears.

Both SembMarine and Keppel Corp hit highs of $4.61 and $12.34 respectively on June 2, when the price of crude oil was on an unprecedented uptrend and just a month before it hit an all-time high of over US$147 in July.

When the oil price started sliding below US$100 per barrel after that high point, the stock prices of the two counters followed suit. And when oil prices briefly spiked back up above US$100, the stock prices of the two counters mirrored this movement, albeit on a much smaller scale.

With oil falling below US$50 last Thursday, the prospects for the two counters look poor if investors were to assume that the correlation will hold. However, the fundamental question that needs to be asked is if that rationale for the correlation was valid in the first place.

Firstly, new order announcements have slowed, not stopped, in the second half. Keppel Offshore and Marine managing director and chief operating officer Tong Chong Heong was recently quoted as saying that the group had 'not yet reached a point of panic' because most of its projects were properly funded and the yards had work all the way till about 2012 to 2013 with a net order book of $13 billion as at Sept 30.

Trying to pin down an oil price at which continued investment in new rigs will stop is at best an academic exercise. But the fact remains that demand for oil will continue to rise and so will the demand for rigs needed to find that oil.

According to a recent report by Ocean Shipping Consultants, even in a low case (price) scenario, offshore oil production is forecast to increase by 39 per cent between now and 2020.

The other key fact is that even as oil demand increases, the supply of rigs will not keep pace. Over 65 per cent of the global mobile rig fleet is over 25 years old and should be due for scrapping but owners have deferred this due to high current charter rates. New building orders account for just 20 per cent of the current offshore rig fleet.

Secondly, while both companies are known as rig builders accounting for more than two-thirds of global newbuilds and while it seems that the big rig deals with impressive headline numbers have tapered off, it should be realised that this is not all that they can do. For example, each of them are also recognised ship repair and conversion yards in their own right.

In fact, the margins on some of the other less attention-grabbing jobs they undertake are actually better than the rig jobs. Repair and conversion jobs see average margins of 25-30 per cent while the usual margin on a rig newbuild is no more than 10 per cent.

Nonetheless, contracts continue to trickle in and the type of jobs being secured seem to be indicating just such a shift.

Keppel announced several conversion and fabrication contracts worth a total of $340 million last week. SembMarine's most recent contract for the first in a series of LNG carrier life extensions was just last month.

DMG and Partners analyst Serene Lim notes in a recent report on SembMarine that 'the repair and conversion business division is counter-cyclical in nature'.

'In this weak credit market whereby we could possibly expect slowing new order momentum, we believe this non-rig building segment is likely to bring in relatively stable revenue stream.'

' We noted that historically, these combined revenue contributions from repair and conversion projects had been increasing through these years, $1.4 billion in FY05, $1.5 billion in FY06 and $1.9 billion in FY07,' she adds, maintaining her 'buy' call and a target price of $2.49.

OCBC Investment Research's Kelly Chia, meanwhile, resumed coverage of Keppel with a 'buy' call also and a fair value price of $5.20.

-Research Report by VINCENT WEE (24 Nov)

LOOKING at the one-year price charts of SembCorp Marine, Keppel Corp and the benchmark crude oil grade, a close correlation appears.

Both SembMarine and Keppel Corp hit highs of $4.61 and $12.34 respectively on June 2, when the price of crude oil was on an unprecedented uptrend and just a month before it hit an all-time high of over US$147 in July.

When the oil price started sliding below US$100 per barrel after that high point, the stock prices of the two counters followed suit. And when oil prices briefly spiked back up above US$100, the stock prices of the two counters mirrored this movement, albeit on a much smaller scale.

With oil falling below US$50 last Thursday, the prospects for the two counters look poor if investors were to assume that the correlation will hold. However, the fundamental question that needs to be asked is if that rationale for the correlation was valid in the first place.

Firstly, new order announcements have slowed, not stopped, in the second half. Keppel Offshore and Marine managing director and chief operating officer Tong Chong Heong was recently quoted as saying that the group had 'not yet reached a point of panic' because most of its projects were properly funded and the yards had work all the way till about 2012 to 2013 with a net order book of $13 billion as at Sept 30.

Trying to pin down an oil price at which continued investment in new rigs will stop is at best an academic exercise. But the fact remains that demand for oil will continue to rise and so will the demand for rigs needed to find that oil.

According to a recent report by Ocean Shipping Consultants, even in a low case (price) scenario, offshore oil production is forecast to increase by 39 per cent between now and 2020.

The other key fact is that even as oil demand increases, the supply of rigs will not keep pace. Over 65 per cent of the global mobile rig fleet is over 25 years old and should be due for scrapping but owners have deferred this due to high current charter rates. New building orders account for just 20 per cent of the current offshore rig fleet.

Secondly, while both companies are known as rig builders accounting for more than two-thirds of global newbuilds and while it seems that the big rig deals with impressive headline numbers have tapered off, it should be realised that this is not all that they can do. For example, each of them are also recognised ship repair and conversion yards in their own right.

In fact, the margins on some of the other less attention-grabbing jobs they undertake are actually better than the rig jobs. Repair and conversion jobs see average margins of 25-30 per cent while the usual margin on a rig newbuild is no more than 10 per cent.

Nonetheless, contracts continue to trickle in and the type of jobs being secured seem to be indicating just such a shift.

Keppel announced several conversion and fabrication contracts worth a total of $340 million last week. SembMarine's most recent contract for the first in a series of LNG carrier life extensions was just last month.

DMG and Partners analyst Serene Lim notes in a recent report on SembMarine that 'the repair and conversion business division is counter-cyclical in nature'.

'In this weak credit market whereby we could possibly expect slowing new order momentum, we believe this non-rig building segment is likely to bring in relatively stable revenue stream.'

' We noted that historically, these combined revenue contributions from repair and conversion projects had been increasing through these years, $1.4 billion in FY05, $1.5 billion in FY06 and $1.9 billion in FY07,' she adds, maintaining her 'buy' call and a target price of $2.49.

OCBC Investment Research's Kelly Chia, meanwhile, resumed coverage of Keppel with a 'buy' call also and a fair value price of $5.20.

-Research Report by VINCENT WEE (24 Nov)

Next week 24 - 28 Nov Data

US DATA

Nov 24

Oct existing home sales

Nov 25

Chain deflator - Q3

preliminary results

GDP - Q3 preliminary

Nov consumer confidence

Nov 26

Oct durable orders

Initial job claims

Oct personal income

Oct personal spending

Nov Chicago PMI

Oct new home sales

SINGAPORE DATA

Nov 24

Oct consumer price index

Nov 26

Oct index of industrial production

Nov 28

Oct central government operations

Oct producer and international trade price indices

Nov 24

Oct existing home sales

Nov 25

Chain deflator - Q3

preliminary results

GDP - Q3 preliminary

Nov consumer confidence

Nov 26

Oct durable orders

Initial job claims

Oct personal income

Oct personal spending

Nov Chicago PMI

Oct new home sales

SINGAPORE DATA

Nov 24

Oct consumer price index

Nov 26

Oct index of industrial production

Nov 28

Oct central government operations

Oct producer and international trade price indices

Saturday, November 22, 2008

Week shows the worst not over

by R SIVANITHY (20 Nov)

NOTWITHSTANDING yesterday's short - covering bounce, the week just passed has served as a grim reminder to investors everywhere that the worst is not yet over for equities.

Wall Street's collapse throughout the week on deflationary worries as oil prices continued to crash, Citibank's plummet to US$4.71 per share on Thursday on worries about its future, the likelihood that General Motors might go bust, the awful US jobless and housing numbers, the US Treasury abandoning its supposedly crucial US$700 billion bailout plan - the list goes ever on.

Whatever the case, few observers placed any faith in yesterday's 48.15-point gain for the Straits Times Index (STI), most probably taking the opportunity to sell into short-covering strength.

For the week, the STI lost 97 points or 5.5 per cent to 1,662.10, falling continuously between Monday and Thursday. Not surprisingly, banks were hit again - DBS started the week at $10.34 but ended at $9.60 for a loss of more than 7 per cent, UOB's loss was one per cent and OCBC's 6 per cent.

Daiwa Institute of Research's Nov 19 report on the banks probably summed it up best when it said there is no reason to change its negative view on the sector after the Q3 results. 'We believe the quarterly net profit declines (average of 23 per cent) experienced by all banks for Q3 are a precursor of the weak operating conditions they face in 2009 and 2010,' said Daiwa.

Morgan Stanley (MS), in the meantime, said in its Nov 19 Asia Pacific Banks report that it has identified 39 banks in its regional coverage that may require some form of equity raising (ordinary equity issuance, dividend policy change, divestment, etc), to just increase their core equity tier one ratio to at least 9 per cent which amounts to about US$80 billion in new equity.

'The US$80 billion does not include capital strain/destruction from the emerging credit cycle and macro slowdown. At this stage, we have no clear view on the likely depth and breadth of these cycles, but suffice to say US$80 billion is unlikely to be enough.

Moreover, as the developed world moves to higher levels of absolute capital adequacy, will rating agencies and capital providers require Asia to maintain the previous relative gap ... ie, is even 9 per cent core equity tier one enough?' asked MS.

In his weekly roundup, AMP Capital's strategy head Shane Oliver said with the US's leading indicator of economic growth at its lowest reading in over 15 years, the worsening outlook means the US Federal Reserve will have to cut its short-term interest rates again at next month's meeting.

Next week, Wall Street will be closed on Thursday for Thanksgiving but will have to deal with a barrage of economic reports such as home sales, house prices, consumer confidence and durable goods orders.

As for the local market, DBS Vickers yesterday released a Singapore Market Focus entitled 'Cautious' in which it said with earnings deteriorating and assuming a recession with -2 per cent GDP growth, the STI could test 1,250.

-Research Report by R SIVANITHY (20 Nov)

NOTWITHSTANDING yesterday's short - covering bounce, the week just passed has served as a grim reminder to investors everywhere that the worst is not yet over for equities.

Wall Street's collapse throughout the week on deflationary worries as oil prices continued to crash, Citibank's plummet to US$4.71 per share on Thursday on worries about its future, the likelihood that General Motors might go bust, the awful US jobless and housing numbers, the US Treasury abandoning its supposedly crucial US$700 billion bailout plan - the list goes ever on.

Whatever the case, few observers placed any faith in yesterday's 48.15-point gain for the Straits Times Index (STI), most probably taking the opportunity to sell into short-covering strength.

For the week, the STI lost 97 points or 5.5 per cent to 1,662.10, falling continuously between Monday and Thursday. Not surprisingly, banks were hit again - DBS started the week at $10.34 but ended at $9.60 for a loss of more than 7 per cent, UOB's loss was one per cent and OCBC's 6 per cent.

Daiwa Institute of Research's Nov 19 report on the banks probably summed it up best when it said there is no reason to change its negative view on the sector after the Q3 results. 'We believe the quarterly net profit declines (average of 23 per cent) experienced by all banks for Q3 are a precursor of the weak operating conditions they face in 2009 and 2010,' said Daiwa.

Morgan Stanley (MS), in the meantime, said in its Nov 19 Asia Pacific Banks report that it has identified 39 banks in its regional coverage that may require some form of equity raising (ordinary equity issuance, dividend policy change, divestment, etc), to just increase their core equity tier one ratio to at least 9 per cent which amounts to about US$80 billion in new equity.

'The US$80 billion does not include capital strain/destruction from the emerging credit cycle and macro slowdown. At this stage, we have no clear view on the likely depth and breadth of these cycles, but suffice to say US$80 billion is unlikely to be enough.

Moreover, as the developed world moves to higher levels of absolute capital adequacy, will rating agencies and capital providers require Asia to maintain the previous relative gap ... ie, is even 9 per cent core equity tier one enough?' asked MS.

In his weekly roundup, AMP Capital's strategy head Shane Oliver said with the US's leading indicator of economic growth at its lowest reading in over 15 years, the worsening outlook means the US Federal Reserve will have to cut its short-term interest rates again at next month's meeting.

Next week, Wall Street will be closed on Thursday for Thanksgiving but will have to deal with a barrage of economic reports such as home sales, house prices, consumer confidence and durable goods orders.

As for the local market, DBS Vickers yesterday released a Singapore Market Focus entitled 'Cautious' in which it said with earnings deteriorating and assuming a recession with -2 per cent GDP growth, the STI could test 1,250.

-Research Report by R SIVANITHY (20 Nov)

Friday, November 21, 2008

More selling as recession fears mount

by R SIVANITHY (20 Nov)

ST Index sheds 3 per cent as part of region-wide stocks hammering after Wall Street dives

WALL Street's 5 per cent plunge to a five-and- a-half-year low on Wednesday sent stocks in this part of the world tumbling yesterday, serving a grim reminder to investors everywhere that the worst is not over for equities.

The US market's rout came after the release of more poor economic numbers, including thin housing starts and low consumer prices - with both figures fuelling deflationary worries.

Adding to the gloom yesterday was news that Japan's exports fell the most in six years, confirming that the global slowdown is taking a firm grip.

The result was a 4 per cent slump in Hong Kong's Hang Seng Index and a 51.64-point or 3.1 per cent loss for the Straits Times Index to 1,613.95, taking it about 13 points above its most recent low of 1,600.28, reached on Oct 24.

Banks were again hit. All three closed weaker, led by DBS's 34-cent slide to $9.16. Daiwa Institute of Research said in a Wednesday report on Singapore banks that it sees no reason to change a previous 'negative' view of the sector.

'We believe the quarterly net profit decreases (an average of 23 per cent) experienced by all banks for Q308 are a precursor of the weak operating conditions they will face in 2009 and 2010,' Daiwa said.

'We believe the sector is set for another depressing industry-wide decline of 8.2 per cent year-on-year for 2009, led by further year-on-year declines in fees and other income and a flare-up of loan-related allowances.' It maintained its 'underperform' ratings on UOB and OCBC, and a 'hold' on DBS.

Government-linked conglomerates continued to be sold down yesterday, though Keppel Corp managed to close unchanged at $4.49 after touching $4.30. Sembcorp Industries (SCI) dropped 12 cents to $2.03, while Sembcorp Marine (SMM) fell 15 cents to $1.65.

In a Nov 18 report, Deutsche Bank maintained a 'buy' on all the three stocks, with price targets of $7.80, $3.55 and $2.45 for Keppel, SCI and SMM respectively.

'While near-term uncertainties remain due to the global financial and economic turmoil, we believe long-term trends remain intact for the offshore and marine sector and through a flight to quality, may likely see future orders gravitate towards the more established players,' said Deutsche.

Credit Suisse maintained its 'underweight' rating on Singapore in a Nov 19 strategy report, saying 'low solvency risk does not mean no risk'. It did state, however, that Singapore Inc is well-placed to weather the storm because corporate debt at 32 per cent for FY08 is easily manageable.

In his latest Insights, AMP Capital's strategy head Shane Oliver said recession is now advanced in key developed economies such as Japan and Europe, and it is only a matter of time before the US officially declares that it too is in recession.

He also said that although there are some common features, this is not a normal slump that typically comes as part of a boom-bust cycle.

'Two considerations make this global slump potentially more serious and hence add to the level of uncertainty,' he said. 'First, we are faced with significant systemic risk as the flow of credit has been radically impaired. On top of this, most countries are weakening at the same time. The synchronisation in economic downturns in the US, Japan and Europe is now making the global downturn worse.'

-Research Report by R SIVANITHY (20 Nov)

ST Index sheds 3 per cent as part of region-wide stocks hammering after Wall Street dives

WALL Street's 5 per cent plunge to a five-and- a-half-year low on Wednesday sent stocks in this part of the world tumbling yesterday, serving a grim reminder to investors everywhere that the worst is not over for equities.

The US market's rout came after the release of more poor economic numbers, including thin housing starts and low consumer prices - with both figures fuelling deflationary worries.

Adding to the gloom yesterday was news that Japan's exports fell the most in six years, confirming that the global slowdown is taking a firm grip.

The result was a 4 per cent slump in Hong Kong's Hang Seng Index and a 51.64-point or 3.1 per cent loss for the Straits Times Index to 1,613.95, taking it about 13 points above its most recent low of 1,600.28, reached on Oct 24.

Banks were again hit. All three closed weaker, led by DBS's 34-cent slide to $9.16. Daiwa Institute of Research said in a Wednesday report on Singapore banks that it sees no reason to change a previous 'negative' view of the sector.

'We believe the quarterly net profit decreases (an average of 23 per cent) experienced by all banks for Q308 are a precursor of the weak operating conditions they will face in 2009 and 2010,' Daiwa said.

'We believe the sector is set for another depressing industry-wide decline of 8.2 per cent year-on-year for 2009, led by further year-on-year declines in fees and other income and a flare-up of loan-related allowances.' It maintained its 'underperform' ratings on UOB and OCBC, and a 'hold' on DBS.

Government-linked conglomerates continued to be sold down yesterday, though Keppel Corp managed to close unchanged at $4.49 after touching $4.30. Sembcorp Industries (SCI) dropped 12 cents to $2.03, while Sembcorp Marine (SMM) fell 15 cents to $1.65.

In a Nov 18 report, Deutsche Bank maintained a 'buy' on all the three stocks, with price targets of $7.80, $3.55 and $2.45 for Keppel, SCI and SMM respectively.

'While near-term uncertainties remain due to the global financial and economic turmoil, we believe long-term trends remain intact for the offshore and marine sector and through a flight to quality, may likely see future orders gravitate towards the more established players,' said Deutsche.

Credit Suisse maintained its 'underweight' rating on Singapore in a Nov 19 strategy report, saying 'low solvency risk does not mean no risk'. It did state, however, that Singapore Inc is well-placed to weather the storm because corporate debt at 32 per cent for FY08 is easily manageable.

In his latest Insights, AMP Capital's strategy head Shane Oliver said recession is now advanced in key developed economies such as Japan and Europe, and it is only a matter of time before the US officially declares that it too is in recession.

He also said that although there are some common features, this is not a normal slump that typically comes as part of a boom-bust cycle.

'Two considerations make this global slump potentially more serious and hence add to the level of uncertainty,' he said. 'First, we are faced with significant systemic risk as the flow of credit has been radically impaired. On top of this, most countries are weakening at the same time. The synchronisation in economic downturns in the US, Japan and Europe is now making the global downturn worse.'

-Research Report by R SIVANITHY (20 Nov)

China Hongx 211108

China Hongxing opened right on the downtrend (mid red) and 0.180 support (lightblue...) before recovering to close above the 0.190 neckline (lightblue --). However, China Hongxing is still trading within the downtrend channel (red).

If China Hongxing continues to trade within the uptrend channel (blue), and above the 0.190 neckline (lightblue --), we could see it testing the 0.205 resistance (blue --) next week, which is also where the downtrend resistance (upp red) meets the uptrend resistance (upp blue).

However, if China Hongxing breaks the 0.180 support, we could see it test the oct lows again.

For monday :